Introduction

Option selling is a powerful strategy that allows traders to earn consistent returns by collecting premiums. Unlike option buyers who aim for large directional moves, option sellers benefit from time decay (Theta) and non-movement in price. In this guide, we will explore the best option selling strategies, their risk-reward profiles, and when to use them.

Why Sell Options?

Option sellers have a higher probability of profit because they capitalize on:

✅ Time Decay (Theta) – As options lose value over time, sellers benefit.

✅ Implied Volatility (IV) Crush – When IV decreases, option premiums drop, helping sellers.

✅ Market Range Bound Behavior – Most stocks/indexes trade in a range, favoring neutral strategies.

Best Option Selling Strategies

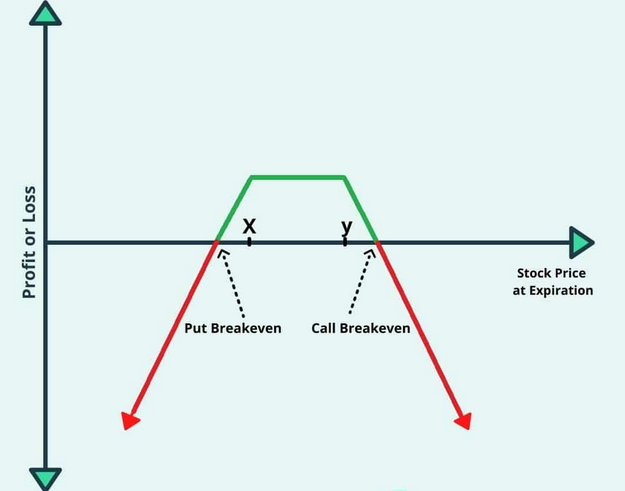

A. Short Strangle – Earning from Sideways Markets

A Short Strangle involves selling an Out-of-the-Money (OTM) Call and Put of the same expiry. This strategy works when the stock/index stays within a defined range.

📌 Setup:

Sell OTM Call

Sell OTM Put

Ensure both have the same expiry📊 Payoff Diagram:

✅ Best Time to Use:

High IV (before events like earnings)

Expected low volatility or range-bound market⛔ Risk:

Unlimited if the stock makes a big move

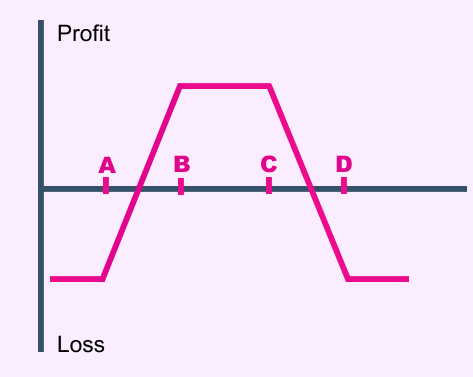

Must manage with stop-loss or hedgeB. Iron Condor – Limited Risk Income Strategy

An Iron Condor is a non-directional strategy combining a short strangle with defined risk by buying farther OTM options.

📌 Setup:

Sell OTM Call

Buy higher OTM Call (protection)

Sell OTM Put

Buy lower OTM Put (protection)📊 Payoff Diagram:

✅ Best Time to Use:

High IV environment

Markets expected to trade within a range⛔ Risk:

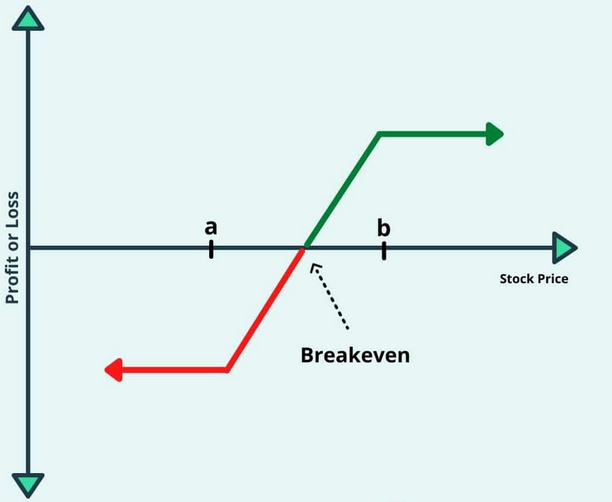

Limited risk but needs adjustments if price moves too muchC. Credit Spreads – Safe Option Selling

Credit spreads are safer than naked selling. Traders sell a high-premium option and buy a lower-premium option to limit losses.

i. Bear Call Spread (For Bearish Market)

Sell ATM or OTM Call

Buy a higher OTM Callii. Bull Put Spread (For Bullish Market)

Sell ATM or OTM Put

Buy a lower OTM Put📊 Payoff Diagram (Bull Put Spread):

✅ Best Time to Use:

When expecting slow price movement

During range-bound or slightly trending markets⛔ Risk:

Loss is limited but needs proper position sizingRisk Management in Option Selling

🔹 Hedge with farther OTM options – Reduce margin and risk

🔹 Adjust positions when needed – Roll up/down strikes if price moves

🔹 Avoid event days (high volatility) – Expiry days can be unpredictable

🔹 Follow Position Sizing – Never risk more than 2-3% of capital per trade

Conclusion

Option selling is a highly effective way to generate consistent income if done with proper risk management. Strategies like Short Strangle, Iron Condor, and Credit Spreads allow traders to capitalize on time decay and non-movement in price. However, traders must hedge risks, avoid over-leverage, and adjust positions when needed.